Enjoy Zero Charges on 28 Commonly Used Savings Account Services

Existing Customer +91 6234345789

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

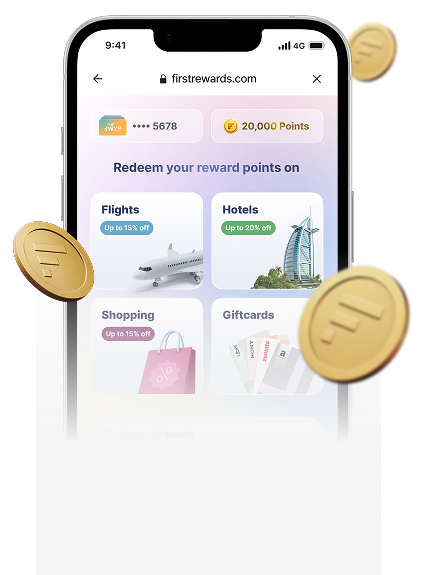

Book smarter, shop better.

1 Reward Point = ₹0.25

Bonus Reward Points on every ₹100 spent

Bonus Reward Points on every ₹100 spent

When a loan is taken out to purchase a pre-owned car, it is called a repurchase loan.

A Current Account is an account that is used by business enterprises or self-employed professionals to carry out business-related transactions. It allows businesses to carry out a higher number of transactions daily.

Anyone who meets any of the following requirements can apply:

- Self Employed Professionals

- Hindu Undivided Family (H.U.F.)

- Sole Proprietorship

- Partnership

- OPC / Private & Public Limited Company

- Limited Liability Partnership

You can open an IDFC FIRST Bank Current Account by visiting your nearest bank branch or click here to apply online.