Enjoy Zero Charges on 28 Commonly Used Savings Account Services

- Accounts

- Deposits

-

Loans

IDFC FIRST Bank Loans

View all Loans -

Wealth & Insure

IDFC FIRST Bank Wealth & Insure

View all Wealth & Insure -

Payments

IDFC FIRST Bank Payments

View all Payments -

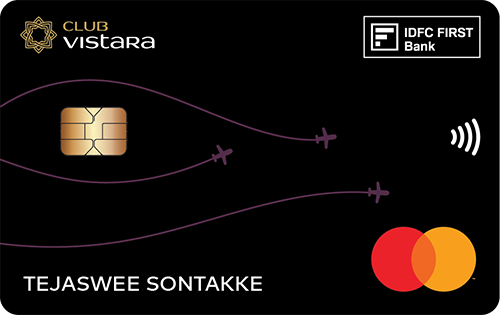

Cards

IDFC FIRST Bank Cards

View all Cards

- Metal Collection

-

For Travel

IDFC FIRST Bank for Travel

-

For UPI

IDFC FIRST Bank for UPI

-

Assured Cards (FD-Backed)

IDFC FIRST Bank’s Assured Cards

-

Rewards for All

IDFC FIRST Bank’s Rewards for all

-

Commercial Cards

IDFC FIRST Bank’s Commercial Cards

-

More

More from IDFC FIRST Bank

- FIRST Booster

-

SME Accounts

IDFC FIRST Bank Business Accounts

View all Accounts - Startup Solutions

- SME Loans

-

Business Solutions

- Debit Card

-

Offers

- Rocket Current Account

-

Lending

IDFC FIRST Bank Lending

View all -

Trade

IDFC FIRST Bank Trade

View all - Corporate Linked Finance

-

Cash Management Services

IDFC FIRST Bank Cash Management Services

View all Cash Management Services -

Treasury

IDFC FIRST Bank Treasury

See more details

-

Enjoy Zero Charges on 28 Commonly Used Savings Account Services

Enjoy Zero Charges on 28 Commonly Used Savings Account Services

Enjoy Zero Charges on 28 Commonly Used Savings Account Services

-

Customer care 1800 10 888