Existing Customer +91 6234345789

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Our vision at IDFC FIRST Bank is to build a technology-driven bank that always puts customer first. We are constantly working on ways to serve you better, which is why IDFC FIRST Bank provides you with multiple channels to access your account details & provide the support you need.

Here are the channels you can use to bank with us:

For a prompt response, you can raise request here

If you are raising a query for the first time, you can also reach out via our assisted channels:

In case you are dissatisfied with the resolution provided and want to escalate an unresolved issue, below are the channels for escalation :

Nodal Officer

Principal Nodal officer

If you are not a customer, or have an issue that is not related to any of our products or services, Click here

Please note that we will only commit to a turnaround time if you use the channels mentioned above for raising a request or query.

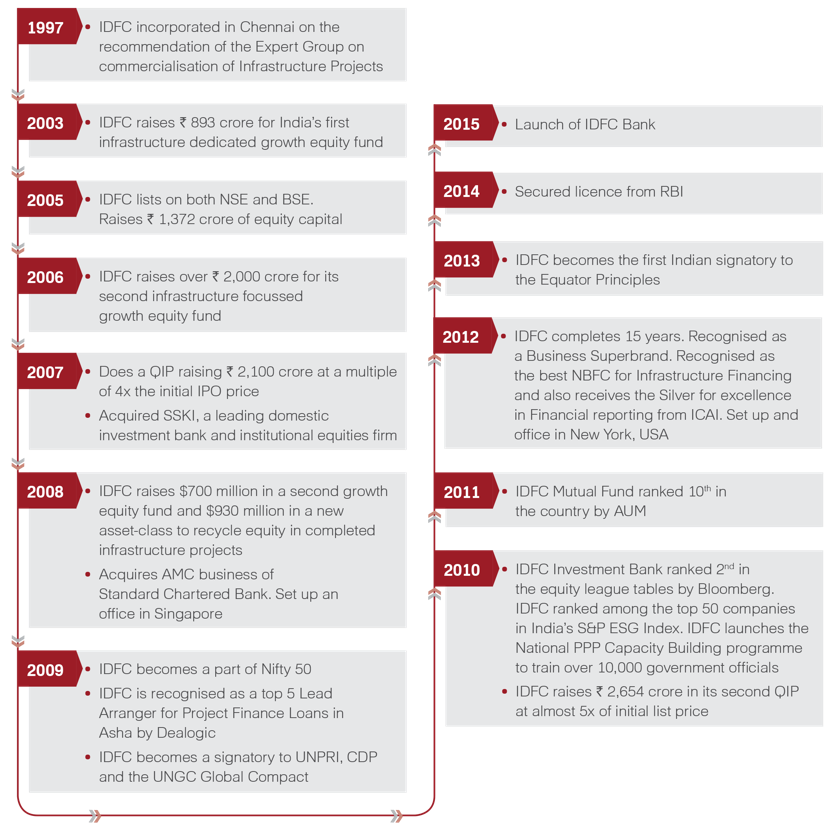

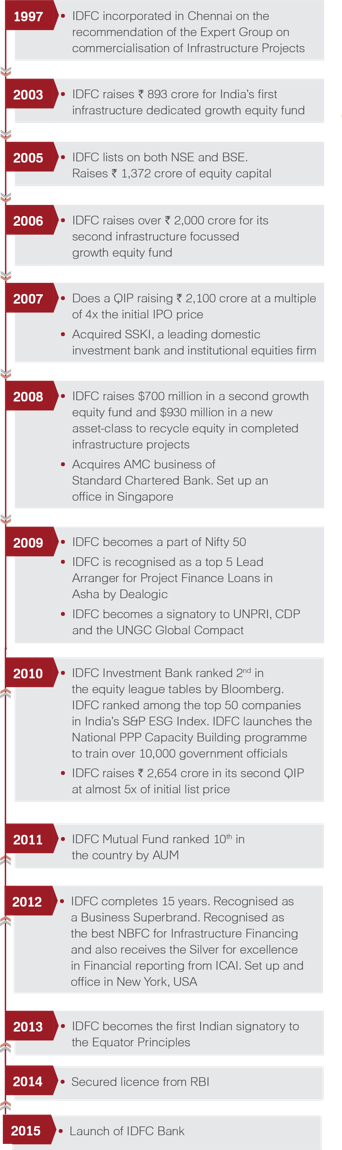

IDFC Limited was set up in 1997 to finance infrastructure focusing primarily on project finance and

mobilization of capital for private sector infrastructure development. Whether it is financial

intermediation for infrastructure projects and services, whether adding value through innovative products to

the infrastructure value chain or asset maintenance of existing infrastructure projects, the company focused

on supporting companies to get the best return on investments. The Company’s ability to tap global as well

as Indian financial resources made it the acknowledged experts in infrastructure finance. Dr. Rajiv Lall

joined the company in 2005 and successfully expanded the business to Asset Management, Institutional Broking

and Infrastructure Debt Fund. He applied for a commercial banking license to the RBI in 2013. In 2014, the

Reserve Bank of India (RBI) granted an in-principle approval to IDFC Limited to set up a new bank in the

private sector. Following this, the IDFC Limited divested its infrastructure finance assets and liabilities

to a new entity - IDFC Bank- through demerger. Thus IDFC Bank was created by demerger of the infrastructure

lending business of IDFC to IDFC Bank in 2015.

The bank was launched through this demerger from IDFC Limited in November 2015. During the subsequent three

years, the bank developed a strong and robust framework including strong IT capabilities for scaling up the

banking operations. The Bank designed efficient treasury management system for its own proprietary trading,

as well as for managing client operations. The bank started building Corporate banking businesses.

Recognizing the change in the Indian landscape, emerging risk in infrastructure financing, and the low

margins in corporate banking, the bank launched retail business for assets and liabilities and put together

a strategy to retailize its loan book to diversify and to increase margins. Since retail required

specialized skills, seasoning, and scale, the Bank was looking for inorganic opportunities for merger with a

retail lending partner who already had scale, profitability and specialized skills.

Mr Vaidyanathan who had built ICICI Bank’s Retail Banking business from 2000-2009 and was then

the MD and

CEO of ICICI Prudential Life Insurance Company in 2009-10, quit the group for an entrepreneurial foray to

acquire a stake in an existing NBFC with the stated intent of converting the NBFC to a commercial bank

financing small businesses. During 2010-12, he acquired a significant stake in a real-estate financing NBFC

through personal leverage, and launched businesses of financing small entrepreneurs and consumers. The NBFC

wound down existing businesses and instead started businesses of financing such segments within consumer and

micro-entrepreneurs that not financed by existing banks, by using alternative and advanced technology led

models. He built a prototype for such financing (Rs 12000-Rs. 30,000, ~$300- $500), built a loan book of Rs.

770 crore ($130m, March 2011) within a year, and presented the proof of concept to many global private

equity players for a Leveraged Management Buyout. In 2012, he concluded India’s largest Leveraged Management

Buyout, got fresh equity of Rs. 100 crore into the company and founded Capital First as a new entity with

new shareholders, new Board, new business lines, and fresh equity infusion.

Between March 31, 2010 to March 31, 2018, the Company’s Retail Assets under Management increased from Rs. 94

crore ($14m) to Rs. 29,625 crore ($4.3 b, Sep 2018). The company financed seven million customers for Rs.

60,000 crore ($8.5b) through new age technology models. The company turned around from losses of Rs. 30

crore and Rs. 32 crore in FY 09 and FY 10 respectively, to PAT of Rs. 327 crore ($ 4.7b) by 2018,

representing a 5 year CAGR increase of 56%. The loan assets grew at a 5 year CAGR of 29%. The ROE steadily

rose from losses in 2010 to 15% by 2018. The market capitalization of the company increased ten-fold from

Rs. 780 crore on in March 2012 at the time of the MBO to over Rs. 8,282 crore in January 2018 at the time of

announcement of the merger. As per its stated strategy, the company was looking out for a banking license to

convert to a bank.

Growth is real only when it is sustainable and serves the long-term interest of stakeholders. An aspiration for accelerated and sustained growth paved the way for the merger of erstwhile IDFC Bank Ltd and erstwhile Capital First Ltd on December 18, 2018. Thus, a new bank with a new DNA was born – IDFC FIRST Bank. The merger is a milestone in the history of the two institutions and marks the end of one journey and beginning of a new one.

IDFC FIRST Bank is born to be distinctly different from what it was earlier. It has a renewed focus on retail business with an intent to fast-forward its growth trajectory, and to serve many more customer segments that are seen as growth-drivers of the Indian economy. Our new bank fuses state-of-the-art technology and the superior liability platform of erstwhile IDFC Bank with analytics-led lending capabilities, the retail DNA and strong profitability track record of erstwhile Capital First. It enables both the institutions to expand capabilities and reach and to better serve customers. Thus, the merger sets the stage for the creation of a financially and strategically stronger entity. IDFC FIRST Bank now has a strong funded asset base of more than ₹ 1,10,400 crore with 37% in the retail segment. Its quarterly annualised Net Interest Margin has expanded from 1.9% to 3.0% post merger. The Bank now enjoys a leading position in some of the retail asset segments. The Bank’s tech-driven liabilities platform is ready to grow exponentially with a new focus on expanding footprint across the nation. The combined customer base is now 7.3 million and growing, with a significant share of it in India’s booming hinterland.

IDFC FIRST Bank is born to be distinctly different from what it was earlier. It has a renewed focus on retail business with an intent to fast-forward its growth trajectory, and to serve many more customer segments that are seen as growth-drivers of the Indian economy. Our new bank fuses state-of-the-art technology and the superior liability platform of erstwhile IDFC Bank with analytics-led lending capabilities, the retail DNA and strong profitability track record of erstwhile Capital First. It enables both the institutions to expand capabilities and reach and to better serve customers. Thus, the merger sets the stage for the creation of a financially and strategically stronger entity. IDFC FIRST Bank now has a strong funded asset base of more than ₹ 1,10,400 crore with 37% in the retail segment. Its quarterly annualised Net Interest Margin has expanded from 1.9% to 3.0% post merger. The Bank now enjoys a leading position in some of the retail asset segments. The Bank’s tech-driven liabilities platform is ready to grow exponentially with a new focus on expanding footprint across the nation. The combined customer base is now 7.3 million and growing, with a significant share of it in India’s booming hinterland.

IDFC FIRST Bank is born to be distinctly different from what it was earlier. It has a renewed focus on retail business with an intent to fast-forward its growth trajectory, and to serve many more customer segments that are seen as growth-drivers of the Indian economy. Our new bank fuses state-of-the-art technology and the superior liability platform of erstwhile IDFC Bank with analytics-led lending capabilities, the retail DNA and strong profitability track record of erstwhile Capital First. It enables both the institutions to expand capabilities and reach and to better serve customers. Thus, the merger sets the stage for the creation of a financially and strategically stronger entity. IDFC FIRST Bank now has a strong funded asset base of more than ₹ 1,10,400 crore with 37% in the retail segment. Its quarterly annualised Net Interest Margin has expanded from 1.9% to 3.0% post merger. The Bank now enjoys a leading position in some of the retail asset segments. The Bank’s tech-driven liabilities platform is ready to grow exponentially with a new focus on expanding footprint across the nation. The combined customer base is now 7.3 million and growing, with a significant share of it in India’s booming hinterland.

The new brand identity of IDFC FIRST Bank signifies growth and energy. It reflects the progressive spirit of our times. The symbolism behind our new identity is drawn from the theme of ‘progress’. Inspired by a forward-moving bar graph, it embodies a symbol of growth that can be seen and measured. The three bars stand for a threefold purpose - progress of the bank, progress of our customers and progress of the nation.

We aspire to create the world’s best bank, right here in India, for aspiring Consumers and Entrepreneurs.

We want to touch the lives of millions of indians in a positive way by providing high-quality banking services to them, using contemporary technologies.

Our Cultural Tenets to guide every action we take

We put the customer’s interest first by putting ourselves in the customer’s situations and viewing things from their perspective.

We develop, maintainn and strengthen relationships with both internalannd external stakeholders.

We constantly strive to innovate in the customer interest.

We trust our employees ability to be successful, especially at challenging new tasks; delegating responsibility and authority.

We exercise best judgement by making sound and well-informed decisions.

We consistently demonstrate focus, initiative and energy to deliver our promise of delighting customers.

The founding years, which I call the next five years, are particularly important, as the DNA we establish now will be hard to correct later. We will make every effort to sell the right products to customers, avoid mis-selling, avoid selling such third-party products that make wonderful fees for us but at the cost of expensive products for the customer. If we make a mistake, we will apologise and correct it. After all, we do not want to take this Bank to great heights in profits and profitability while having earned any penny that truly does not belong to us”

We plan to implant the erstwhile Capital First’s tried and tested model of financing small entrepreneurs and consumers (a retail franchise, growing at 29% per annum and 5-year profit CAGR of 55%, (FY 18 PAT grew by 37%)), on a bank platform, (IDFC Bank’s strong branch network of 580 and growing, excellent technology stack, quality internet and mobile banking, and strong rural presence).

MD & CEO, IDFC FIRST Bank

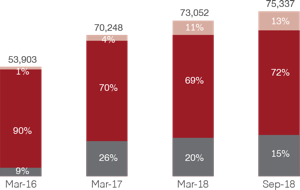

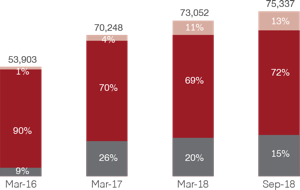

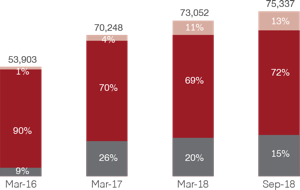

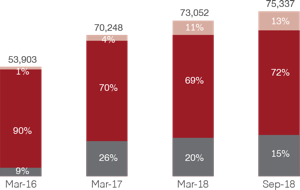

The Loan Assets of the Bank increased at a moderate pace over the years as the Bank inherited the legacy infrastructure financing book from its parent IDFC Ltd. In FY16, the Bank started the retail financingbook and increased it to ` 9,916 crore contributing 13% of the overall funded assets as of September 30, 2018. Retail assets was planned for increase as a percentage of overall loan book.

The Loan Assets of the Bank increased at a moderate pace over the years as the Bank inherited the legacy infrastructure financing book from its parent IDFC Ltd. In FY16, the Bank started the retail financingbook and increased it to ` 9,916 crore contributing 13% of the overall funded assets as of September 30, 2018. Retail assets was planned for increase as a percentage of overall loan book.

The Loan Assets of the Bank increased at a moderate pace over the years as the Bank inherited the legacy infrastructure financing book from its parent IDFC Ltd. In FY16, the Bank started the retail financingbook and increased it to ` 9,916 crore contributing 13% of the overall funded assets as of September 30, 2018. Retail assets was planned for increase as a percentage of overall loan book.

The Loan Assets of the Bank increased at a moderate pace over the years as the Bank inherited the legacy infrastructure financing book from its parent IDFC Ltd. In FY16, the Bank started the retail financingbook and increased it to ` 9,916 crore contributing 13% of the overall funded assets as of September 30, 2018. Retail assets was planned for increase as a percentage of overall loan book.