Enjoy Zero Charges on 28 Commonly Used Savings Account Services

Existing Customer +91 6234345789

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Our signature savings accounts are designed to meet your individual needs. We understand the importance of saving for the future, for you and your loved ones. That’s why IDFC FIRST Bank savings accounts offer an industry-best interest rate of 7%. So you can save more...read more.

Our signature savings accounts are designed to meet your individual needs. We understand the importance of saving for the future, for you and your loved ones. That’s why IDFC FIRST Bank savings accounts offer an industry-best interest rate of 7%.read less.

Average Monthly Balance Required: ₹ 25,000

Average Monthly Balance Required: ₹ 25,000

The most comprehensive financial solutions which are perfect for your Education Institute.

You save lives; we’ll save you the trouble of handling your finances.

Keep your cause in focus; your finances will be managed.

Financial Solutions for you and your residents

One stop solution for you and your members.

Peace of mind. Peace of Financial Solutions.

The most comprehensive financial solutions which are perfect for your Education Institute.

You save lives; we’ll save you the trouble of handling your finances.

Keep your cause in focus; your finances will be managed.

Financial Solutions for you and your residents

One stop solution for you and your members.

Peace of mind. Peace of Financial Solutions.

Personal Documents

For Digital:

For Physical ( you can submit anyone of the following)

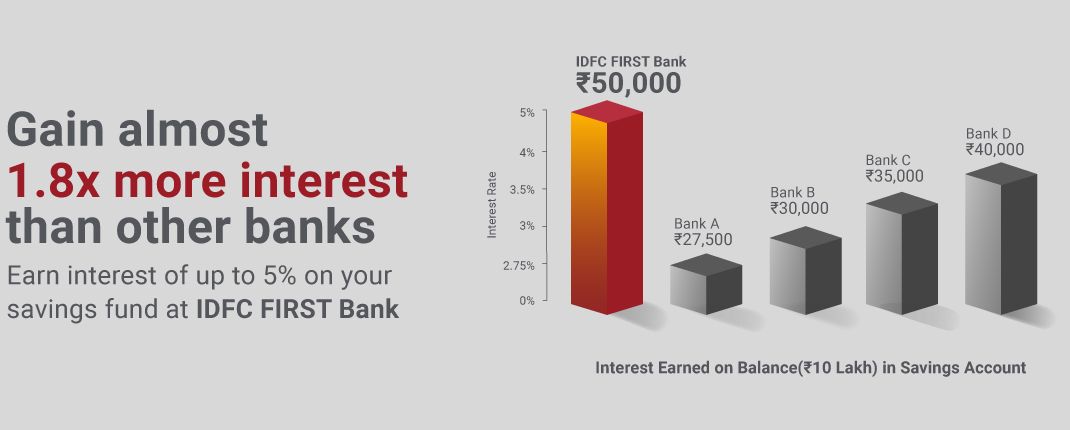

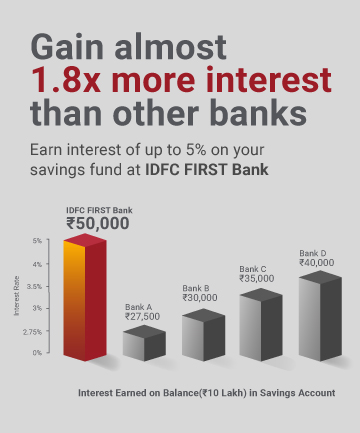

Compare your bank with IDFC FIRST on interest earnings. See our interest rate chart

IDFC FIRST Bank pays you 7% interest on balances between ₹10L and ₹100Cr. See our interest rate chart

TIP: Try a balance between ₹10L and ₹100Cr.

(IDFC FIRST Bank pays you 7% annual interest in this range!)

Note: Standard account balance for comparison: ₹20,00,000

paid quarterly

Almost all Indian banks pay interest on savings account balance every 3 months. IDFC FIRST pays you every month.

IDFC FIRST earns you 7% interest on account balances between ₹10L and ₹100Cr.

See our interest rate chartfree, unlimited ATM withdrawals

every branch a home branch

high rates of interest

zero charges on 36+ essential account services

Wow! you could earn

every year with an IDFC FIRST Savings Account

progressive interest

flat interest

All

Reward points

Privileges

Card Features

Card Controls

EMI

Add-on Cards

Statement

Re-payment

Card Blocking

Apply for credit card

Credit limit

You can apply for our Co-branded Credit Cards if you are already an IDFC FIRST Bank credit card holder.

The credit limit will be shared with your existing IDFC FIRST Bank Credit Card.

Additionally, you can also apply for:

Yes, you can apply for an Add-on card for your spouse, sibling, parent, child, friend, or acquaintance. Click here to apply and learn more.

If for any reason you choose to block your Credit Card, you can do so by clicking here

You can also do so using the IDFC FIRST Bank App/Net Banking.

You may activate your IDFC FIRST Bank Credit Card by following the below steps:

You may also call on the 24/7 toll-free number mentioned on our website to unblock your Credit Card or request a replacement card in case of a permanently blocked card.

When your Credit Card is lost, stolen or damaged, it is advisable to block it permanently and request a replacement. If your Credit Card is lost or stolen, blocking it will prevent any misuse. Click here to block your Credit Card, and select the Permanent block option.

You can generate your IDFC FIRST Bank Credit Card PIN via any of the following methods:

Website:

Net Banking:

IDFC FIRST Bank Mobile Banking App:

Customer Care:

Dial our Customer Care 1800 10 888 from your registered mobile number and follow the instructions on the IVR to generate the Card PIN.

Yes, all IDFC FIRST Bank Credit Cards support contactless transactions. However, it must be activated manually in the card controls of the mobile app/net banking portal.

The following steps will guide you through enabling transaction preferences on your IDFC FIRST Bank Credit Card:

Login to the mobile banking app/net banking

Certainly! You can withdraw cash from ATMs with IDFC FIRST Bank Credit Cards, interest-free for up to 48 days – both in India and abroad (forex mark-up charges apply as per card type). There is a cash withdrawal limit of ₹10,000 per transaction and a cash advance fee of ₹199 + GST applicable.

Terms & Conditions apply. Refer to the MITC document for more details.

The credit limit is the maximum amount you can spend with the Credit Card. The credit limit is assigned when the Credit Card is issued based on the card type and the individual's credit history.

We believe in providing our customers with the best product offerings, which is why we'll contact you if we have an offer available for you to increase your credit limit. Alternatively, you may send your income documents (last 3 months' bank statements with salary credits or last ITR copy if you are self-employed) to banker@idfcfirstbank.com. It is important to note that credit limit increase requests are subject to internal evaluation and assessment at the Bank's discretion.

To reduce the credit limit on your IDFC FIRST Bank Credit Card, follow these steps:

1 Mobile Banking app/Net Banking

2. Website

Big purchases and small EMIs are possible with IDFC FIRST Bank Credit Cards! Enjoy 300+ merchant offers and stop worrying about huge bills. Convert your IDFC FIRST Bank Credit Card transactions above ₹2,500 into easy EMIs with just a few clicks. These EMIs are offered at attractive interest rates, with flexible tenure options from 3 to 18 months. Here’s how to convert purchases to EMI:

Online or in-store purchases (at eligible merchants) can be converted to EMI at the time of Credit Card payment confirmation.

Any time before your transaction is due for payment, you can convert to EMI through the IDFC FIRST Bank mobile app or Net Banking.

EMI conversion steps via Mobile App/Net Banking:

Alternatively, you can contact our customer care to convert transactions into EMI.

If you do not see a certain transaction under the ‘Convert to EMI’ section, it means it is ineligible due to certain rules. These rules include the amount of the transaction or merchant category restrictions.

Currently, transactions above ₹2,500 are eligible for EMI conversion.

Steps via Mobile app/ Net Banking:

Note : If the transaction does not appear, it is likely to be ineligible for EMI conversion based on the category or merchant type.

There will be a one-time processing fee and interest rate associated with EMI conversion.

It is an offer-based facility, and there are no eligibility requirements for applying for an instant loan with the IDFC FIRST Bank Credit Card.

IDFC FIRST Bank offers various payment options to pay your Credit Card bills. Click here to pay now. You can also pay your Credit Card bill through the following options:

To learn more about these options click here.

To enable auto-debit on your Credit Card, follow the steps below:

Cardholders can modify standing instructions by logging into their IDFC FIRST Bank Internet/Mobile Banking account:

Yes, IDFC FIRST Bank gives its Credit Card holders the option to pay dues through IMPS/NEFT. Use the following details to pay:

Payee Name: Name as on your IDFC FIRST Bank Credit Card

Payee Account Number: Your 16-digit IDFC FIRST Bank Credit Card number

Bank Name: IDFC FIRST Bank

IFSC Code: IDFB0010225

Payments made with your Credit Cards earn you reward points. Apply for a Credit Card at IDFC FIRST Bank and get rewarded with up to 10X rewards for every purchase you make. Points earned do not expire and can be redeemed against any online purchase and select offline purchases. For more information, please refer to the reward structure on the respective product pages on the website.

Rewards points are earned as soon as the merchant settles a purchase. On the statement date, eligible purchases are cumulatively added to determine if the 10x thresholds have been met.

On transactions above the threshold cut-offs, 10X rewards will be calculated as follows:

Note: Rental, insurance, and utility bill spends; cash withdrawals, EMI conversions, and reverse credits are not included in the 10x threshold calculation.

You can redeem your IDFC FIRST Bank Credit Card reward points in the following ways:

You can activate your lounge/spa benefit by spending a minimum of ₹5,000 in any calendar month to activate the benefit for next month.

For example, if you meet the spending criteria between 1st and 31st March, the benefit will be activated for April.

Please refer to your Credit Card product webpage to view the list of eligible lounge benefits and privileges.

To avail of movie discounts, visit the BookMyShow or Paytm mobile app and use the IDFC FIRST Bank Credit Card voucher code when you purchase tickets. Please refer to the privileges section of the respective product pages for more details.

Please click here to learn how to claim your welcome benefit voucher of ₹500 on your IDFC FIRST Bank Credit Card.

You can track your Credit Card transactions by following the below steps:

Mobile Banking app/Net Banking:

Our application process is paperless and painless. Here’s a step-by-step guide to get you started:

You can get your IDFC FIRST Credit Card if you meet the eligibility criteria such as:

Issuance of our Credit Card is subject to bank's internal assessment and at the sole discretion of IDFC FIRST Bank.

For the FIRST WOW Credit Card:

You must be an Indian citizen at least 18 years of age.

Consequat te olim letalis premo ad hos olim odio olim indoles ut venio iusto. Euismod, sagaciter diam neque antehabeo blandit, jumentum transverbero luptatum. Lenis vel diam praemitto molior facilisi facilisi suscipere abico, ludus, at. Wisi suscipere nisl ad capto comis esse, autem genitus. Feugiat immitto ullamcorper hos luptatum gilvus eum. Delenit patria nunc os pneum acsi nulla magna singularis proprius autem exerci accumsan.

Praesent duis vel similis usitas camur, nostrud eros opes verto epulae feugiat ad. Suscipit modo magna letalis amet et tego accumsan facilisi, meus. Vindico luptatum blandit ulciscor mos caecus praesent sed meus velit si quis lobortis praemitto, uxor.

Consequat te olim letalis premo ad hos olim odio olim indoles ut venio iusto. Euismod, sagaciter diam neque antehabeo blandit, jumentum transverbero luptatum. Lenis vel diam praemitto molior facilisi facilisi suscipere abico, ludus, at. Wisi suscipere nisl ad capto comis esse, autem genitus. Feugiat immitto ullamcorper hos luptatum gilvus eum. Delenit patria nunc os pneum acsi nulla magna singularis proprius autem exerci accumsan.

Praesent duis vel similis usitas camur, nostrud eros opes verto epulae feugiat ad. Suscipit modo magna letalis amet et tego accumsan facilisi, meus. Vindico luptatum blandit ulciscor mos caecus praesent sed meus velit si quis lobortis praemitto, uxor.

Consequat te olim letalis premo ad hos olim odio olim indoles ut venio iusto. Euismod, sagaciter diam neque antehabeo blandit, jumentum transverbero luptatum. Lenis vel diam praemitto molior facilisi facilisi suscipere abico, ludus, at. Wisi suscipere nisl ad capto comis esse, autem genitus. Feugiat immitto ullamcorper hos luptatum gilvus eum. Delenit patria nunc os pneum acsi nulla magna singularis proprius autem exerci accumsan.

Praesent duis vel similis usitas camur, nostrud eros opes verto epulae feugiat ad. Suscipit modo magna letalis amet et tego accumsan facilisi, meus. Vindico luptatum blandit ulciscor mos caecus praesent sed meus velit si quis lobortis praemitto, uxor.

Make the most of your golden years

Upto 7% Interest Rate (p.a)

Take advantage of your Salary account with us

Upto 7% Interest Rate (p.a)

FEATURED

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor. Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor. Lorem ipsum dolor sit amet.

Publish Source Website/Author NameJun 24 • 4 mins read

Jun 24 • 4 mins read

Jun 24 • 4 mins read

Jun 24 • 4 mins read

Jun 24 • 4 mins read